Can Financial Statement Income Exceed Taxable Income?

The title of this blog might have you calling your tax accountant asking, “How can you work this magic for my company?” Well before you do that let’s first start with the basics. Financial statement income is based on Generally Accepted Accounting Principles (GAAP) rules of revenue and expense recognition which is primarily accrual based, while taxable income is based on the IRC’s (Internal Revenue Code) rules. These differences in revenue and expense treatment result in what is referred to as an “M-1” adjustment.

What is an M-1 Adjustment?

An “M-1”, which is known as an adjustment to GAAP income, is a tax concept that can either increase or decrease GAAP income when determining taxable income. The differences between GAAP and tax income are noted on the “Schedule M-1” of the tax return, typically located on page 5 of the tax returns of partnerships and corporations. There are two types of M-1 adjustments: permanent and temporary timing differences.

Temporary Timing Differences

Temporary timing differences are created when revenue or expense is recognized in different periods for financial and tax purposes but are eventually equalized. Meaning, they will have no impact on GAAP income in the long run. One of the more common timing differences is depreciation. While GAAP lives and methods are typically consistent from year to year, tax depreciable lives and methods can vary each year based on the changing tax laws. This can result in accelerated depreciation, which can save your company significant tax dollars. Fixed assets with accelerated deprecation will depreciate quicker for tax than those for GAAP in earlier years, but eventually GAAP depreciation will exceed tax depreciation in the future years of those assets, and the net affect will be zero.

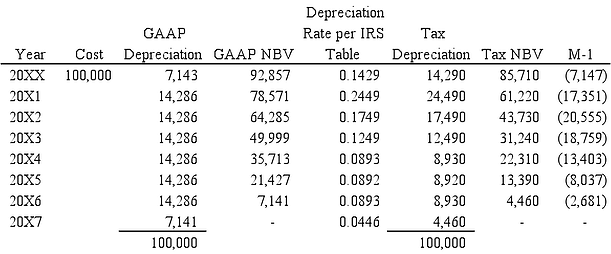

For example, on July 1, 20XX you place in service a piece of machinery which you purchased for $100,000. For GAAP purposes you elect to depreciate the machinery using the straight line method over it’s commonly used seven year useful life. For tax purposes, you elect accelerated depreciation for the machinery using the common MACRS 200% declining balance method. In the table below, we have calculated the GAAP and tax depreciation and the temporary timing difference (M-1) based on our scenario.

You’ll note that in years 20XX-20X2, tax depreciation exceeds GAAP depreciation, creating a favorable M-1, which reduces your taxable income. Then in year 20X3, the M-1 flips and GAAP depreciation exceeds tax depreciation until the final year when the asset is fully depreciated for both GAAP and tax purposes.

Other common temporary timing differences include:

- Inventory Reserve – Any increase in the reserve for inventory obsolescence, which is an allowable expense for GAAP, is added back to GAAP net income for tax purposes. Since this reserve is an estimate, the expense generally cannot be taken for tax until the loss is recognized and the inventory is actually disposed.

- Bad Debt Allowance – Much like a change in an inventory reserve, any increase in the allowance for bad debts, which is also an allowable expense for GAAP, is disallowed for tax purposes until the bad debt is realized and collection methods are exhausted.

- Warranty Reserve – The increase in warranty reserve is added back to financial net income for tax purposes. GAAP requires companies to recognize the warranty expense in the period when a product warranty claim is likely to occur based on management’s estimate. However, tax rules disallow the expense until cash is paid out for the warranty claim.

- Accrued Vacation – Accrued vacation expense is disallowed for tax purposes unless it is paid within two and a half months after year end.

Permanent Differences

Permanent differences can arise when revenue or expense on GAAP financial statements will never be deductible or recognized on income tax returns. For example, the life insurance premiums paid for an officer of the company are expensed on GAAP financial statements but are not deductible on the tax return.

Other common permanent timing differences include:

- Life insurance proceeds – If a corporation receives life insurance proceeds upon the death of an employee, it is income for financial accounting but is usually not taxable, with a few exceptions.

- Business Meals & Entertainment expense – 100% deductible for financials, but limited to a 50% deduction for tax purposes.

- Fines and Penalties – These expenses occur when a business breaks civil, criminal, or statutory law. For example, if a company breaks a local zoning ordinance, the penalties or fines are expensed for financial statements but disallowed against taxable income.

Staying current with changes in tax law is a task in itself. There can be numerous factors that come into play when you are planning for the tax year, and they can have a significant impact on the taxable income of your Company. Typically, the M-1’s noted above, and their impact on your Company, are reviewed by your accountant during attest and tax planning services. With the proper planning and understanding of these changes, your Company can stay a step ahead. For further questions on this topic, please contact us!

If you liked this blog post, you might also enjoy:

A Different Set of Accounting Rules for Private Companies

Tax Strategies for Privately Held Businesses

Handling Medicare Tax on Investment Income

Joseph is a Senior Manager at Meaden & Moore.